We understand the liquidity needs of our clients and value the time and effort that their workforce invests in forming a patrimony; therefore, we provide financing and savings alternatives to optimize your financial management, both for customers and employees.

Financing to Clients for Working Capital

We know that our clients also need financing; therefore, we coordinate to put at your disposal a line of credit for working capital to face situations of lack of liquidity. The client financing model we manage is short term (maximum 12 months), for a maximum amount of 2 months of the value of your payroll and at an annual rate of 24%.

Financing to Workers for Consumption

We provide micro-financing to our workers for the consumption of goods at rates lower than the market. The financing model that we manage is aimed at supporting these workers in emergency situations, so it is limited to short-term financing (maximum 12 months), for a maximum amount of 2.5 months of salary and at a preferential annual rate of plus 24%.

Savings Bank

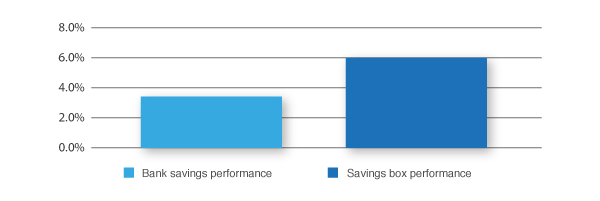

We put at the disposal of the workers savings banks with yields superior to those granted by banking institutions (annual average rate of plus 2%) to promote the formation of their assets.